Jennifer Meierhans,Business reporter and

Henry Zeffman,Chief Chief Political

BBC

BBCChancellor Rachel Reeves says she will make “necessary choices” in the budget after “the world throws up many challenges to our approach”.

In an unusual pre-budget speech on the streets, Reeves did not reign in a U-turn in the General Elececesto Manifesto Commitment not to hike income tax, VAT or National Insurance.

When asked by reporters if the government is set to live up to that pledge he did not answer directly but said he was “setting the context for the budget”.

Conserv Bible Kemi Badenoch said the speech was “a long waffle bomb” that left business leaders “none the wiser”.

He added that the Chancellor “should not impose taxes”, and should copy conservative policies such as the scrapping stamp duty to “stimulate the economy.

Reeves promised to come together with a “budget for growth with fairness at heart” aimed at bringing down NHS waiting lists and the cost of living.

The Chancellor said that he will do what is “necessary to protect families from high inflation and interest in services from a return to default” and is sure to have debt control “.

He added that “we all need to contribute to that effort”.

“Each of us must do our bit for the security of our country and the light of its future.”

The Chancellor’s speech appears to have cleared any doubts as to whether the tax will pay the budget.

Although pressed on where the tax could go up, ReEves declined to go into specifics.

Instead he began the work that explains why a year after delivering a tax budget and vowing not to return, he is actually returning to more.

The Chancellor says he will do what is necessary, not what is popular.

The reasons given by him are poor productivity, for which he blames the conservative policy of the government including Brexit, Continuous decisions made by Global Inflation and the uncertainty unleashed by Donald Trump’s tariffs.

In short, the argument of the realves is that the failures of others are visited on this government, and that it falls on his decisions that are stabbed.

“It’s important that people understand the circumstances we face, the principles that guide my choices — and why I believe they are the right choices for the country,” he said.

Daisy Cooper, Treasury spokeswoman for the liberal Democrats, said: “Clearly this budget will be a bitter pill to swallow as the government seems to be running out of excuses.”

There are some in the Government who want it to be a one-and-done budget, which they don’t want to come back every year, repeating the requirements of the independent forecast.

That can be seen as an argument for raising billions of pounds to increase at least one of the income tax rates.

However, this is a big political risk, especially as public trust in politics in general, and Prime Minister Sir female starmer in particular, is very low.

There is also the question of whether the Prime Minister and Chancellor can land the argument that no one knew before last year’s budget.

It comes as the Foundation Foundation, which has close links to work and was previously run by Treasury Minister Torsen Thorten, said to avoid changes in VAT, nor income tax “.

Chief Executive Ruth Curtice told the BBC “It is very unusual for a chancellor to make a speech three weeks before the budget”.

“There may simply not be enough sensible tax increases to raise the £25bn we think he needs without dealing with those manifestos,” he said.

The Resolution Foundation recommends the Hiking Income Tax as the “best option” for raising money, which should be fixed with a 2P cut of staff from these workers from the tax increase”.

Raising the basic income tax rate is called the 50-year Tax Taboo. Labour’s Denis Healey was the last chancellor to do so in 1975.

Extending the freeze on personal tax thresholds for two more years to April 2028 will also raise £7.5bn, the pre-budget suggests

The government’s official forecaster, the office for budget responsibility (ONR), is widespread It is expected to lower UK productivity forecasts at the end of the month. That could add as much as £20bn to the amount the Chancellor must find if he is to meet his self-imposed “rules of government”.

The two main rules are:

- No borrowing to fund day-to-day public spending at the end of this parliament

- To get the government debt that fell as a share of national income at the end of this parliament

Reeves said in his speech on Tuesday that his commitment to his fiscal rules is “iron-clad” and he gave the clearest carriage that he wants to increase his room to maneuver shocks.

“There will be a reward for getting these decisions right to build more robust public finance headroom to prevent the government from relying on it to act,” he said.

The dollar fell to a seven-month low against the dollar in reference to Reeve’s speech, hitting $1.31 at one point.

That’s the lowest since early April, when stocks rocked global markets.

However, it has since fallen, and analysts say this is partly driven by the rising value of the dollar.

Key measures of UK government borrowing costs also fell after the Chancellor took to the lectern but have since risen slightly above levels before he began speaking.

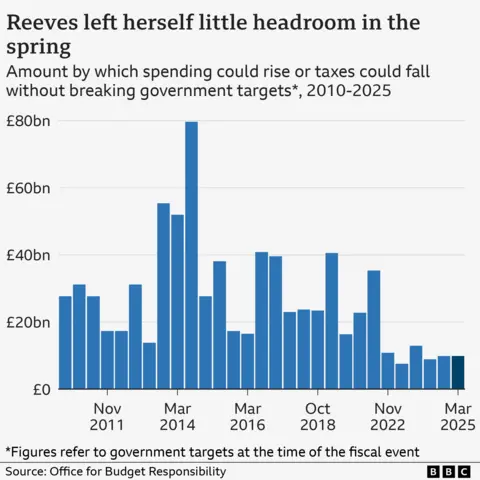

After the last budget there was £9.9bn in headroom, but a series of resolution U-turns and changes in the economic outlook have turned it into a £4bn black hole.

The group urged the Reeves to Double the level of headroom up to £ 20bn to “send a clear message to the markets that he is serious about fixing public borrowing costs and fixing public borrowing costs, without significantly reducing the medium-term west

Last month, the institute for fiscal studies (if) said there was a “strong case” to increase fiscal headroom.

The think tank says that the lack of a greater buffer situation is created, and can leave the Chancellor “Bending from one forecast to the next”.